Taxation Updates 📊 on Twitter: "Draft common Income-tax Return-request for inputs from stakeholders and the general public From @IncomeTaxIndia 1:The proposed draft ITR takes a relook at the return filing system in

How Get Ex-Spouse's Tax Returns? | Indian Wells Divorce | Proving Former Spouse's Income for Support | Family Code Section 3665

Filing Fake Tax Returns and California Tax Fraud (Revenue and Tax Code Section 19706) - Wallin & Klarich

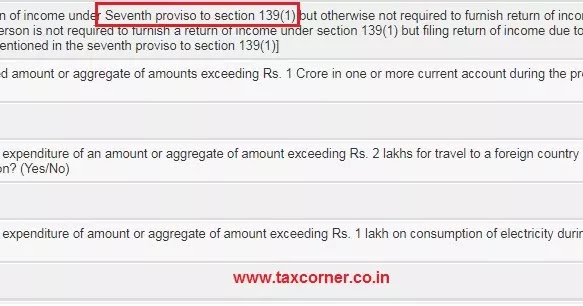

Oportuno.in - Which Income Tax Returns forms to be used for AY 2019 - 20 FY 2018 - 19 ITR 1 cannot be filed if individual is a director in any company

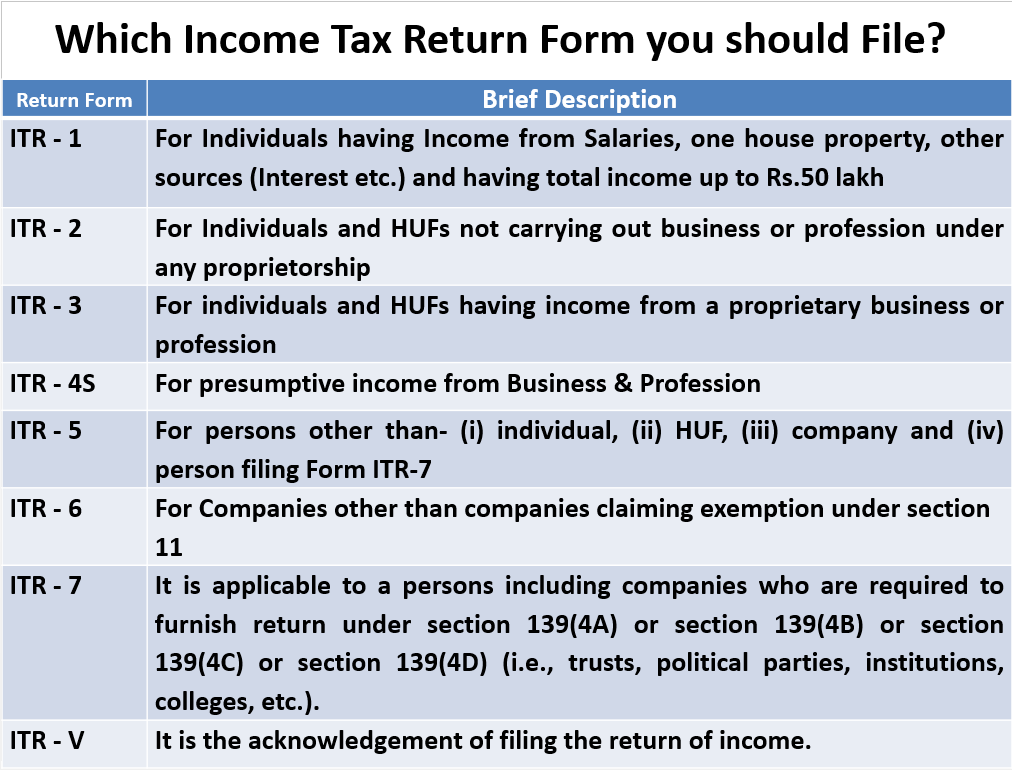

Which is the Best return form for you to File Income Tax return? – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students

Bryan Cave Leighton Paisner - Are Those Taxes Owing On Your Late-Filed Tax Return Dischargeable? Maybe, But You Better Be In The Right Circuit